Embarking on a cruise is an exciting adventure, but ensuring you have the right protection is crucial. In this guide, we delve into the importance of cruise travel insurance, exploring the specific risks of cruise vacations and the benefits it offers compared to regular travel insurance.

As we navigate the world of cruise travel insurance, we'll uncover the various coverage options available, shed light on the significance of medical coverage, and discuss the vital aspects of trip cancellation, interruption, and emergency evacuation.

Importance of Cruise Travel Insurance

When it comes to embarking on a cruise vacation, having proper travel insurance is absolutely essential to ensure a smooth and worry-free trip.

Risks Specific to Cruise Vacations

- Medical Emergencies: Cruise ships may not always have the necessary medical facilities, and medical evacuation can be costly.

- Itinerary Changes: Weather conditions or mechanical issues can lead to unexpected changes in the cruise itinerary.

- Missed Departures: Delays in flights or other transportation to the cruise port can result in missing the ship's departure.

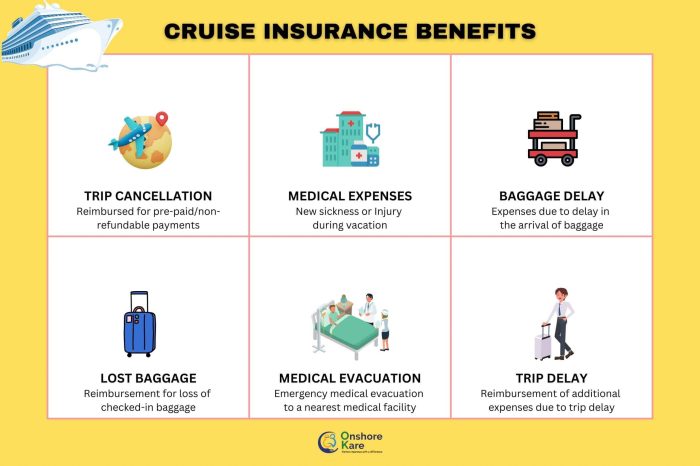

Benefits of Cruise Travel Insurance

- Coverage for Cruise-Specific Incidents: Cruise travel insurance typically includes coverage for missed port departures, itinerary changes, and emergency medical evacuations.

- Reimbursement for Prepaid Expenses: If you have to cancel your cruise due to unforeseen circumstances, cruise insurance can reimburse you for non-refundable costs.

- 24/7 Assistance: Many cruise travel insurance policies offer round-the-clock assistance for emergencies during your trip.

Coverage Options

When it comes to cruise travel insurance, there are various coverage options to consider. Understanding what is typically covered under a cruise travel insurance plan is crucial in ensuring you have the right protection in place for your trip. It is also important to be aware of coverage limits and exclusions to avoid any surprises in the event of a claim.

Types of Coverage

- Trip Cancellation: This coverage typically reimburses you for prepaid and non-refundable trip expenses if you have to cancel your cruise due to a covered reason such as illness or injury.

- Trip Interruption: In case your cruise is interrupted due to unforeseen circumstances, this coverage helps reimburse you for the unused portion of your trip.

- Emergency Medical Expenses: This coverage provides financial protection for medical expenses incurred during your cruise, including emergency medical evacuation if needed.

- Baggage Loss/Damage: If your luggage is lost, stolen, or damaged during your cruise, this coverage can help reimburse you for the value of your belongings.

Covered Items

- Emergency Medical Treatment

- Trip Cancellation/Interruption

- Baggage Loss/Damage

- Travel Delay

- Emergency Evacuation

Understanding Limits and Exclusions

It is essential to carefully review the coverage limits and exclusions of your cruise travel insurance policy to ensure you are aware of any restrictions or conditions that may apply. For example, certain pre-existing medical conditions may not be covered unless specified in the policy.

Knowing these details can help you make informed decisions and avoid any potential issues when making a claim.

Medical Coverage

Traveling on a cruise can be an exciting and relaxing experience, but it's important to be prepared for unexpected medical emergencies that may arise while at sea. This is where medical coverage in cruise travel insurance plays a crucial role in ensuring your well-being and peace of mind during your trip.

Significance of Medical Coverage

Medical coverage in cruise travel insurance provides financial protection in case you need medical treatment while on board or at a port of call. It can cover a wide range of medical expenses, including doctor visits, prescription medications, emergency medical evacuations, and even hospital stays.

Without adequate medical coverage, you could be faced with hefty medical bills that can quickly drain your savings.

Examples of Medical Emergencies

During a cruise, you may encounter various medical emergencies such as seasickness, food poisoning, injuries from onboard activities, or even more serious conditions like heart attacks or strokes. In these situations, having medical coverage can ensure that you receive prompt medical attention without worrying about the cost.

Medical Coverage for Cruises vs. Other Types of Travel

Medical coverage for cruises differs from traditional travel insurance in that it often includes coverage for medical services provided on board the ship or at remote locations. This is important because standard travel insurance may not cover medical treatment received while at sea or in international waters.

Additionally, cruise travel insurance may offer higher coverage limits for medical expenses due to the unique risks associated with cruising.

Trip Cancellation and Interruption

When it comes to cruise travel insurance, trip cancellation and interruption coverage play a crucial role in protecting travelers from unexpected events that may force them to cancel or cut short their trip.

How Trip Cancellation and Interruption Coverage Works

Trip cancellation coverage typically reimburses you for prepaid and non-refundable expenses if you need to cancel your cruise before departure due to covered reasons such as illness, injury, or severe weather conditions. On the other hand, trip interruption coverage helps cover the costs if you have to end your trip early and return home unexpectedly.

- Illness or injury before the trip

- Family emergencies

- Unexpected work-related issues

- Severe weather conditions

- Transportation delays

It's important to carefully review your policy to understand the specific reasons covered for trip cancellation and interruption.

Common Reasons for Trip Cancellations or Interruptions During a Cruise

There are several common reasons why travelers may need to cancel or interrupt their cruise, including:

- Medical emergencies

- Family emergencies

- Natural disasters

- Travel delays or cancellations

- Unforeseen work commitments

Having trip cancellation and interruption coverage can provide peace of mind knowing that you can recoup some or all of your expenses in case of unexpected events.

Emergency Evacuation

In the unfortunate event of a medical emergency during a cruise, having emergency evacuation coverage is crucial for travelers. This coverage ensures that individuals can be safely transported to the nearest appropriate medical facility or even back home if needed.

Importance of Emergency Evacuation Coverage

Emergency evacuation coverage is essential for cruise travelers due to the remote locations of many cruise ship routes. In situations where onboard medical facilities may not be equipped to handle a serious medical emergency, or if immediate specialized care is required, emergency evacuation ensures that travelers can receive the necessary treatment without delays.

This coverage can include arrangements for air ambulances, medical escorts, and coordination of medical care throughout the evacuation process.

Examples of Situations Requiring Emergency Evacuation

- A passenger suffers a severe heart attack while at sea and needs to be transported to a cardiac care facility on land for urgent treatment.

- An individual sustains a serious injury during an onshore excursion and requires immediate evacuation to a hospital for surgery.

- In the event of a natural disaster or onboard emergency that results in the need to evacuate passengers for safety reasons.

How Emergency Evacuation Coverage Helps Travelers

Emergency evacuation coverage ensures that travelers do not have to worry about the high costs and logistical challenges of arranging emergency medical transportation on their own. By having this coverage in place, individuals can focus on their health and well-being during a crisis, knowing that trained professionals are handling the evacuation process efficiently.

This peace of mind is invaluable during emergencies when time is of the essence.

Concluding Remarks

In conclusion, cruise travel insurance serves as a safety net for travelers, providing peace of mind and financial protection against unforeseen circumstances. Whether you're setting sail for a relaxing cruise or an adventurous voyage, having the right insurance can make all the difference in ensuring a worry-free trip.

Detailed FAQs

What specific risks make cruise travel insurance essential?

Cruise travel insurance is crucial due to risks like trip cancellations, medical emergencies at sea, and unforeseen interruptions during your voyage.

What types of coverage are typically included in cruise travel insurance?

Coverage options often include trip cancellation, medical expenses, emergency evacuation, and coverage for lost or delayed baggage.

How does medical coverage in cruise travel insurance differ from other travel insurance?

Medical coverage for cruises is tailored to address unique challenges at sea, such as arranging medical transport to the nearest suitable medical facility.

What are common reasons for trip cancellations or interruptions during a cruise?

Trip cancellations on cruises can occur due to illness, adverse weather conditions, mechanical issues on the ship, or personal emergencies.

When might emergency evacuation coverage be necessary during a cruise?

Emergency evacuation may be required in situations like serious injuries onboard, medical emergencies that can't be handled on the ship, or evacuation to a proper medical facility on land.

![Complete Guide to Buying The Best Travel Insurance [2020]](https://insurance.eastcanyonhotel.com/wp-content/uploads/2025/12/Travel-Insurance-e1536686171876-120x86.jpg)

![Complete Guide to Buying The Best Travel Insurance [2020]](https://insurance.eastcanyonhotel.com/wp-content/uploads/2025/12/Travel-Insurance-e1536686171876-1-120x86.jpg)