Embark on a journey to discover the intricacies of Chase Sapphire travel insurance. From coverage details to filing claims, this guide is your key to understanding all aspects of this insurance policy.

Delve deeper into the nuances of Chase Sapphire travel insurance and unlock the benefits and limitations that come with it.

What is Chase Sapphire Travel Insurance?

Chase Sapphire Travel Insurance is a benefit provided to Chase Sapphire cardholders that offers coverage for various travel-related issues.

Coverage Provided

- Travel accident insurance

- Trip cancellation/interruption insurance

- Baggage delay insurance

- Travel emergency assistance

Benefits and Limitations

Chase Sapphire travel insurance provides peace of mind for cardholders when traveling, offering financial protection in case of unforeseen circumstances. However, it's essential to note that there are limitations and exclusions to the coverage, so it's crucial to review the policy details carefully.

Eligibility Criteria

- Must be a Chase Sapphire cardholder

- May require booking travel with the Chase Sapphire card

- Check specific requirements in the policy documents

Types of Coverage

Travel insurance provided by Chase Sapphire offers a range of coverage options to protect travelers in various situations.

Trip Cancellation

- This coverage reimburses you for prepaid, non-refundable trip expenses if your trip is canceled for a covered reason.

- The coverage limit for trip cancellation typically ranges from $5,000 to $10,000 per person, depending on the specific Chase Sapphire card you hold.

Trip Interruption

- Trip interruption coverage helps reimburse you for unused, non-refundable trip expenses and additional transportation costs to return home if your trip is interrupted for a covered reason.

- The coverage limit for trip interruption is usually similar to that of trip cancellation, ranging from $5,000 to $10,000 per person.

Baggage Delay

- With baggage delay coverage, you can receive reimbursement for essential items like clothing and toiletries if your baggage is delayed for a certain period.

- Chase Sapphire typically offers coverage limits of around $100 to $300 per day for baggage delay, with a maximum total limit per person.

Additional Perks

- In addition to basic coverage, Chase Sapphire travel insurance may include benefits like travel accident insurance, rental car insurance, and trip delay reimbursement.

- These additional perks can provide extra peace of mind and financial protection during your travels.

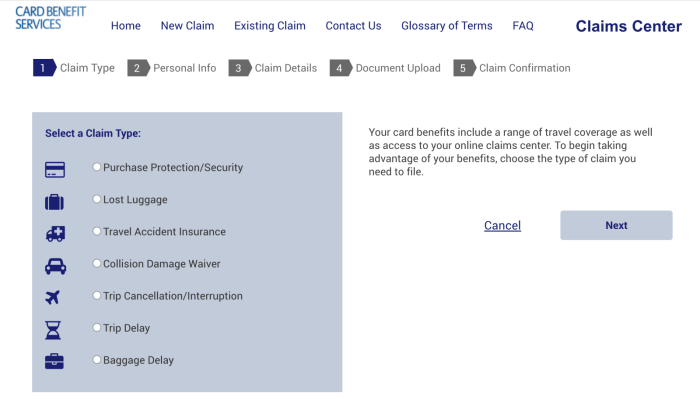

Filing a Claim

When it comes to filing a claim with Chase Sapphire travel insurance, it is essential to follow the necessary steps and provide the required documentation for a smooth process. Here is a step-by-step guide on how to file a claim, along with tips to expedite the process and maximize reimbursement.

Step-by-Step Guide

- Contact Chase Sapphire: Initiate the claim process by contacting Chase Sapphire as soon as possible after the incident.

- Provide Necessary Information: Be prepared to provide details such as your name, account information, incident date, location, and a description of the claim.

- Submit Documentation: Gather and submit all required documentation, including police reports, medical records, receipts, and any other relevant information supporting your claim.

- Follow Up: Stay in touch with the claims department and respond promptly to any requests for additional information or clarification.

- Review and Approval: Once the claim is reviewed and approved, you will receive reimbursement according to the terms of your policy.

Required Documentation

- Proof of Travel: Provide evidence of your travel itinerary, tickets, and reservations.

- Receipts: Keep all receipts related to expenses incurred due to the incident, such as medical bills, hotel stays, and transportation costs.

- Police Reports: If applicable, provide official police reports documenting the incident.

- Medical Records: Include medical records detailing any treatment received as a result of the incident.

Tips for Expedited Processing

- Submit Claims Promptly: File your claim as soon as possible to expedite the processing timeline.

- Organize Documentation: Keep all documentation organized and readily accessible to streamline the claims process.

- Follow Up: Stay proactive and follow up with the claims department to ensure timely processing.

- Provide Complete Information: Make sure to provide all necessary information and documentation to avoid delays.

- Understand Policy Terms: Familiarize yourself with the terms of your policy to maximize reimbursement and avoid discrepancies.

Exclusions and Limitations

When it comes to Chase Sapphire travel insurance, it's important to understand the exclusions and limitations that may apply to your coverage. While the insurance offers valuable protection, certain situations may not be covered, and there are specific restrictions cardholders should be aware of.

Common Exclusions

- Pre-existing medical conditions: Any medical conditions that were present before you purchased the insurance policy may not be covered.

- Extreme sports or activities: Participating in high-risk activities like skydiving or mountaineering may be excluded from coverage.

- War or acts of terrorism: Damages or losses resulting from war or terrorism may not be covered.

- Losses due to intoxication: Any incidents that occur while under the influence of drugs or alcohol may be excluded.

Specific Limitations

- Coverage limits: The insurance policy may have maximum limits on the amount of coverage provided for certain types of losses or expenses.

- Travel destinations: Some regions or countries may not be covered under the insurance policy, so it's important to check the list of eligible locations.

- Duration of coverage: The insurance may only apply to trips of a certain length, so longer journeys may not be fully covered.

Scenarios Where Coverage May Not Apply

- Unapproved travel arrangements: If your trip was not booked using the Chase Sapphire card or did not meet certain criteria, the insurance may not apply.

- Missed deadlines: Failing to meet reporting deadlines or requirements for filing a claim could result in the denial of coverage.

- Non-travel-related incidents: Incidents that are not directly related to your travel plans may not be covered by the insurance policy.

Conclusion

![Chase Sapphire Reserve Card: Travel Insurance Benefits [2025] Chase Sapphire Reserve Card: Travel Insurance Benefits [2025]](https://insurance.eastcanyonhotel.com/wp-content/uploads/2025/12/chase-sapphire-reserve-travel-insurance1.jpg)

In conclusion, Chase Sapphire travel insurance offers a comprehensive suite of benefits, but it's crucial to grasp the exclusions and limitations to make the most of your coverage. Navigate through your travels with confidence knowing you have the right protection in place.

Quick FAQs

What does Chase Sapphire Travel Insurance cover?

Chase Sapphire travel insurance typically covers trip cancellation, trip interruption, baggage delay, and more. It's essential to review your specific policy for detailed coverage.

How do I file a claim with Chase Sapphire Travel Insurance?

To file a claim, you need to contact the Chase Sapphire claims department and provide necessary documentation such as receipts, proof of travel, and any other relevant information.

What are the common exclusions of Chase Sapphire Travel Insurance?

Common exclusions may include pre-existing medical conditions, high-risk activities, and certain destinations under travel advisories. Review your policy for a complete list of exclusions.

![Chase Sapphire Reserve Card: Travel Insurance Benefits [2025]](https://insurance.eastcanyonhotel.com/wp-content/uploads/2025/12/chase-sapphire-reserve-travel-insurance1-700x375.jpg)

![Complete Guide to Buying The Best Travel Insurance [2020]](https://insurance.eastcanyonhotel.com/wp-content/uploads/2025/12/Travel-Insurance-e1536686171876-120x86.jpg)

![Complete Guide to Buying The Best Travel Insurance [2020]](https://insurance.eastcanyonhotel.com/wp-content/uploads/2025/12/Travel-Insurance-e1536686171876-1-120x86.jpg)